In the 21st century, semiconductors have become the building blocks of modern technology, powering everything from smartphones to advanced military systems. As these tiny chips grow increasingly crucial to national security and economic prosperity, a new form of diplomacy has emerged – semiconductor diplomacy.

The recent global chip shortage, affecting over 169 countries, has underscored the critical nature of semiconductors in modern economies. As the global semiconductor landscape evolves, it is clear that no single country can dominate the entire global value chain. The industry relies on a complex, interconnected global network from design to manufacturing, equipment to raw materials. This reality underscores the importance of semiconductor diplomacy in shaping the future of technology and global power dynamics. The article explains the recent developments in the field of semiconductor diplomacy among great powers.

US Strategies in Semiconductor Sector

The United States, long a leader in semiconductor technology, has found its dominance challenged by China’s rapid ascent in the tech sector. Recognising the strategic importance of maintaining its edge, the US has launched a multi-pronged approach to counter China’s ambitions and secure its semiconductor supply chain.

The CHIPS and Science Act passed in 2022 is a cornerstone of America’s semiconductor strategy. With $52.7 billion in funding, including $39 billion for grants and a 25% investment tax credit for fabrication (fab) construction, the Act aims to revitalise domestic chip manufacturing. This move addresses a critical vulnerability: Despite designing many of the world’s most advanced chips, the US had outsourced much of its manufacturing to Asia over the past decades.

Intel, America’s leading chip manufacturer, has played a pivotal role in shaping this policy. Under CEO Pat Gelsinger’s leadership, the company has committed to a $50 billion chip plant in Arizona, reinforcing the state’s position as a semiconductor hub. This investment aligns perfectly with the CHIPS Act’s goal of bolstering national security by ensuring domestic production of critical components.

Beyond domestic efforts, the US has engaged in active diplomacy to create a network of trusted partners in the semiconductor ecosystem. The focus has been on strengthening ties with technologically advanced allies like Japan, South Korea, and the Netherlands – home to ASML, the world’s sole producer of advanced extreme ultraviolet (EUV) lithography machines essential for cutting-edge chip production.

Simultaneously, the US has implemented stringent export controls to limit China’s access to advanced semiconductor technology. These restrictions aim to slow China’s progress in developing state-of-the-art chips, which could be used to enhance its military capabilities and artificial intelligence prowess.

Where does China Stand?

China, for its part, has not been idle. Since 2014, under President Xi Jinping’s directive, China has poured vast resources into its semiconductor industry. The National Integrated Circuit Industry Investment Fund, or “Big Fund,” has raised approximately $47 billion annually to boost domestic chip production. However, despite these efforts, China still lags behind in producing the most advanced chips, highlighting the complexities of this high-tech industry. However, China set its goal to be self-reliant in chip production and produce 25% of total global production by 2030.

The East Asian dominance

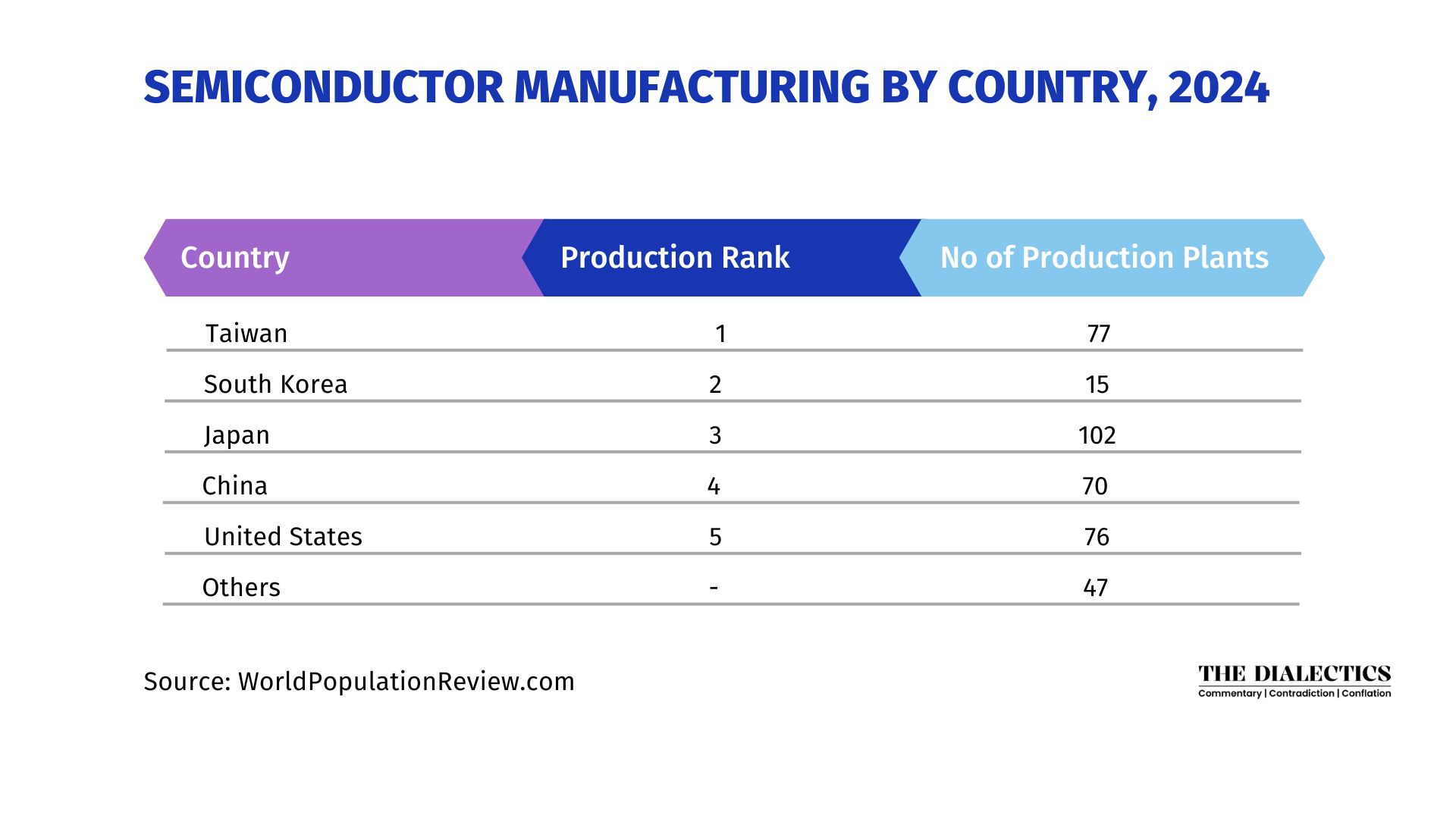

Only a handful of key players dominate the global semiconductor landscape. Taiwan Semiconductor Manufacturing Company (TSMC), with a market cap of $737.28 billion, leads the industry with over 50% market share in advanced chip manufacturing. Taiwan is the undisputed leader in semiconductor manufacturing holding more than half of the total world’s production capacities, mainly due to TSMC’s dominance. South Korea follows closely, led by Samsung and SK Hynix, particularly in memory chip production. Taiwan, South Korea and Japan, the three leading producers of semiconductors, are geographically neighbours of China in the South China Sea and East China Sea. If any geopolitical tensions escalate in the region among these states, especially between China and Taiwan, it would affect supply worldwide. Hence, diversification in semiconductor production is essential in order to maintain the supply chain.

Where does India stand?

As this technological war unfolds, other countries are positioning themselves to play crucial roles in the global semiconductor landscape. With its large pool of tech-savvy talent and growing economy, India has emerged as a potential key player.

Recognizing the opportunity, India has taken significant steps to establish itself in the semiconductor ecosystem. In June 2023, the country approved Micron’s plan to set up a semiconductor assembly and test facility in Gujarat. This moves into the Assembly, Testing, Marking and Packaging (ATMP) segment marks India’s entry into the semiconductor manufacturing chain.

Further cementing its commitment, India has announced plans for multiple chip manufacturing plants. Tata Semiconductor Assembly and Test Pvt Ltd is set to invest $3.26 billion in a plant in Assam. In comparison, a partnership between Tata Electronics and Taiwan’s Powerchip Semiconductor Manufacturing Corp will see an $11 billion investment in a fab in Gujarat. Additionally, CG Power, in collaboration with Japan’s Renesas Electronics and Thailand’s Stars Microelectronics, is planning a $1 billion factory in Gujarat.

These developments position India as a potential alternative to China in the semiconductor supply chain, aligning with many Western companies’ “China Plus One”, a strategy to avoid investing only in China and diversify businesses to other countries to avoid monopoly. However, challenges remain. Building a robust semiconductor ecosystem requires manufacturing capabilities and expertise in chip design, an area where India needs to focus more attention and resources.

Conclusion

The impact of semiconductor manufacturing on the global economy cannot be overstated. The industry is projected to reach $1 trillion by 2030, driven by emerging technologies like electric vehicles, IoT, AI, and cloud computing. The semiconductor industry, once the domain of technologists, has become a critical piece in the great power competition. As nations jockey for position in this high-stakes game, the ability to forge alliances, secure supply chains, and drive innovation will be crucial to success. In this new era of semiconductor diplomacy, the balance of power may well be determined by the countries that can best navigate this complex, interconnected landscape.

Author

-

Anmol Kumar currently works as an Assistant Editor at Defence and Security Alert (DSA) Magazine. He holds a Bachelors in Persian language from Jawaharlal Nehru University and Masters in International Relations from Pondicherry University. He is well known for his research and analyses on topics like defence strategy, geopolitics, West Asia and anything that falls under the purview of international relations.

View all posts