The imposition of tariffs by the European Union on Chinese electric vehicles (EVs) has initiated a convoluted and crucial diplomatic conflict between the two most significant economies globally. This debate has been simmering for months and has enormous ramifications for the global EV market, trade ties, and the fight against climate change. Concerns over alleged unfair competition caused by Chinese EV producers and the effects it might have on the EU’s EV producers led the EU to decide to apply tariffs.

The European Union contends that the subsidies to Chinese businesses offered an unfair competitive edge on the world market, hurting European producers. The EU voted on the proposed tariffs on Chinese electric vehicles on October 4, 2024. The choice was made to move forward with the tariffs, increasing from 17.4 to 38.1 percent rates on Chinese electric vehicles. The worldwide EV market is anticipated to be significantly impacted by this move, given that China is a significant producer and exporter of EVs.

Across the Atlantic

It’s important to note that the EU and the US have addressed this matter differently. Because the US took preventative precautions, it could negotiate this procedure more quickly than the EU. The US’s decision-making was facilitated by its earlier lack of exposure to Chinese BEV imports or US BEV exports to China. The Biden administration levied a wide range of duties on Chinese goods in critical industries in May, raising the tariff rate on Chinese BEVs from 25% to 100% under Section 301 of the Trade Act 1974. According to the administration, unfair, nonmarket behaviours that endanger US jobs and the auto industry result from the Chinese government’s subsidies in that sector.

A few months later, Canada announced that it would raise the tariff rate on Chinese BEV imports from 6.1 per cent to 100 per cent. More recently, in late September, the US Commerce Department proposed regulations that, because of national security concerns, would forbid the sale or import of connected vehicles that use specific technologies and the import of particular components themselves from nations of concern, namely China and Russia.

EU – A House Divided Within

Europe’s response to the EU’s decision to apply tariffs has been divided. While some EU members have supported the plan, particularly those with robust automotive industries, others have voiced worries about the possible detrimental effects on European businesses and consumers. In particular, Germany has criticised the levies, claiming that they will make electric vehicles more expensive for European consumers and reduce the competitiveness of European automakers. Due to Germany’s significant exposure to Chinese markets, Chancellor Olaf Scholz has been an outspoken opponent of the policies.

How China reacts

China is adamantly against the EU’s proposed tariffs. Beijing claimed that the EU was engaging in protectionism and refuted the EU’s accusations of unfair subsidies. In addition, China vowed to sue at the World Trade Organisation (WTO) if the EU moved forward with the tariffs. China has been waging a campaign in recent months to split the EU on this matter before the vote on October 4. After the bloc announced its provisional tariff rates in July, they were somewhat lowered in August after a consultation period, and Beijing increased these efforts even further.

China’s effort included negotiations headed by Ministers of Commerce Wang Wentao and Foreign Affairs Wang Yi, as well as outreach from Xi Jinping at the leadership level. The final vote was moved from September 25 to October 4, indicating some initial success for these efforts. Beijing also provided incentives in the form of investment opportunities, such as collaborative development agreements between European and Chinese automakers or the establishment of electric vehicle production units in various regions of Europe. For instance, Chery Auto, a major Chinese manufacturer of BEVs, intends to set up a production facility in Barcelona to help the business avoid tariffs.

Can the Tariff curtail China ?

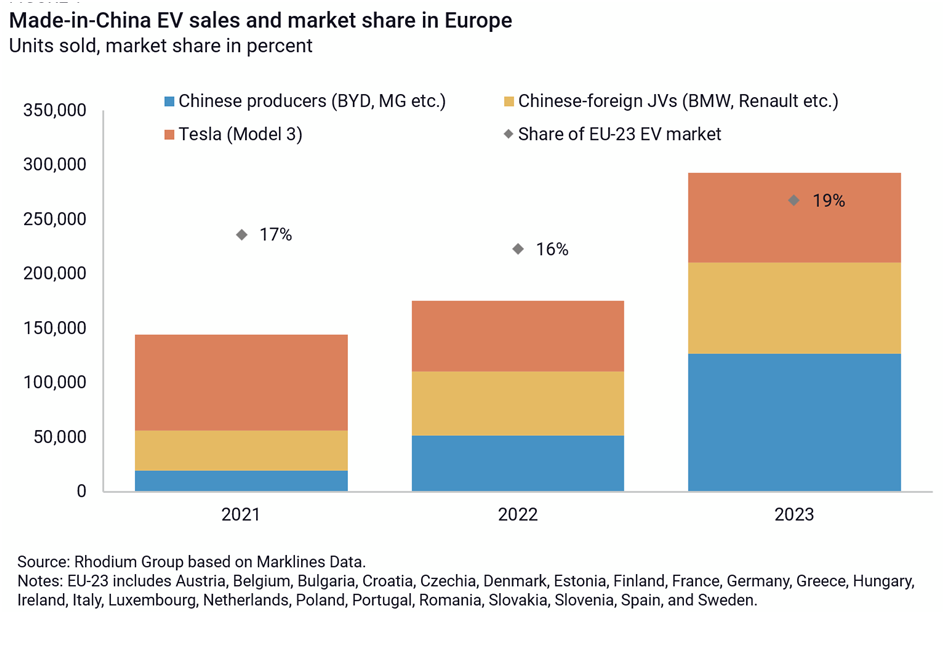

With its move to levy duties on Chinese electric vehicles, the EU has taken a significant stand against what it views as unfair trade practices by China. It seems unlikely that this decision will be the last in the story. With time, Beijing’s efforts to increase the production of BEVs in Europe are expected to lessen the impact of the tariffs and solidify its position in the European market.

Even with certain Chinese BEV companies facing the full impact of the tariffs, data per the Rhodium Group indicates that they are unlikely to be high enough to hinder China’s market share advances materially. Beijing’s actions have successfully lessened the severity of the duties and created the possibility of a possible negotiated settlement even after the tariffs are implemented, which is exacerbated by Germany’s attempts to safeguard the short-term interests of its auto industry.

Concerns and Way Forward

The move by the EU to levy tariffs on Chinese electric vehicles is likely to worsen the situation between the two. A trade war may result from China’s earlier promise to strike with its tariffs. Furthermore, the disagreement may have broader ramifications for the global EV market because it can potentially disrupt supply chains and raise consumer prices. Significant concerns concerning the future of the global EV industry and the function of trade policy in advancing sustainable development are also brought up by the EU-China EV tariff conflict. Governments must cooperate to guarantee fairness for all parties involved in the global transition to electric cars. This will necessitate dealing with market access, intellectual property, and subsidies. Policymakers must balance the urgency of lowering greenhouse gas emissions and the requirement for fair competition as the globe shifts to electric vehicles. The current disagreement over EV tariffs between the EU and China serves as a reminder of the intricate ways that trade policy, environmental objectives, and geopolitical factors interact to shape the future of the global automobile sector.